Pricing Pressure and Shortages in Healthcare: How Supply Chains Are Straining Costs and Access

When you walk into a doctor’s office and are told the medication you’ve been taking for years is no longer available-or the new one costs three times as much-you’re not just dealing with bad luck. You’re feeling the direct impact of pricing pressure and shortages in the healthcare system. These aren’t temporary hiccups. They’re structural shifts that began during the pandemic and are still reshaping how care is delivered, who gets it, and how much it costs.

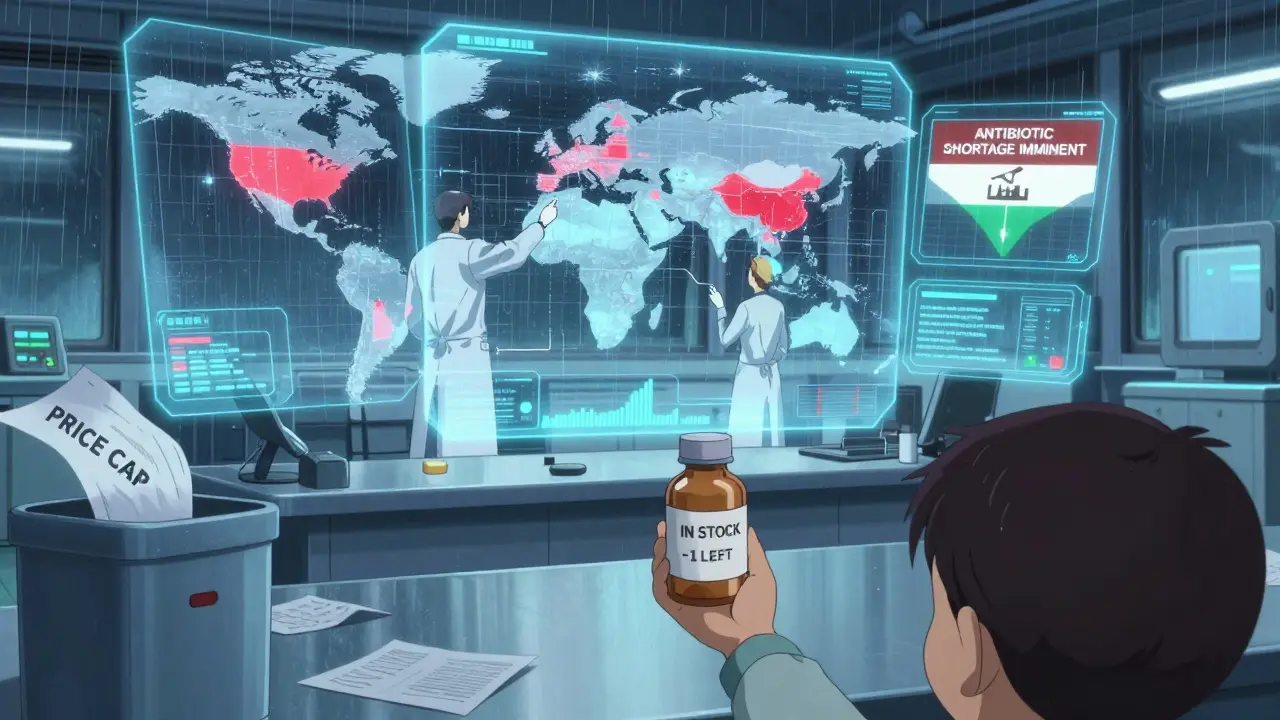

Why Healthcare Supplies Are Running Out

Healthcare doesn’t operate in a vacuum. When global supply chains stumble, medical goods feel it first. Think about the simple things: syringes, IV bags, antibiotics, even basic bandages. In 2021 and 2022, manufacturers couldn’t keep up. A shortage of raw materials, delays at ports, and labor gaps in factories meant hospitals couldn’t restock. The Federal Reserve found that supply chain disruptions contributed nearly 60% of the inflation surge in U.S. goods during that time-and healthcare products were among the hardest hit. One major driver? Concentrated production. A huge chunk of the world’s pharmaceuticals and medical devices come from just a few countries. When China shut down factories during lockdowns, or when a single plant in India faced a power outage, the ripple effect reached hospitals from Dublin to Detroit. In the UK, the Office for Budget Responsibility reported that by late 2021, 30% of essential medicines faced supply delays. Some drugs, like insulin and certain antibiotics, had backlogs lasting over six months.Prices Don’t Just Rise-They Spike Unpredictably

When supply drops and demand stays steady-or even grows-prices don’t gently increase. They explode. The Cleveland Federal Reserve showed that a supply shock in key sectors can push prices up 0.25% almost immediately, while demand shocks only move the needle by 0.05%. In healthcare, that difference matters. A single shortage can turn a $50 drug into a $200 one within months. Take the case of generic injectable drugs. In 2022, the U.S. Bureau of Economic Analysis recorded a 14% year-over-year price jump for common antibiotics like cefazolin and vancomycin. Why? Because only three companies globally made them. When one factory failed an FDA inspection, the others couldn’t scale up fast enough. Hospitals had to pay premiums just to keep patients alive. Even non-pharmaceutical items weren’t spared. IV fluids, which are mostly made from plastic and water, saw price increases of over 50% in 2022. Why? Plastic resin prices surged due to energy shortages. And energy shortages? They came from geopolitical tensions and supply bottlenecks in gas and oil markets. It’s all connected.Who Pays the Price? Patients, Providers, and Systems

When drugs vanish or prices climb, patients don’t just pay more at the pharmacy. They pay in delayed care, worse outcomes, and even death. A 2023 study in the Journal of the American Medical Association found that hospitals forced to substitute unavailable drugs saw a 12% higher rate of treatment failure in infection cases. In some cases, patients had to be moved to intensive care because the standard treatment wasn’t available. Providers aren’t immune. Clinics and small hospitals, especially outside major cities, often lack the buying power of big health systems. When a drug becomes scarce, big networks can pay extra to secure stock. Smaller clinics? They wait. Or they ration. One nurse in rural Ireland told a local reporter in early 2023 that she had to choose between giving two patients half-doses of a critical antibiotic-or giving one patient the full dose and letting the other go without. And then there’s the system itself. Health insurers, government programs like Medicare and Medicaid, and public health budgets are being stretched thin. The European Central Bank estimated that supply chain disruptions added 0.7 percentage points to inflation across Europe in 2022. In healthcare, that translated to a 15% increase in public spending on pharmaceuticals in the UK and Ireland alone-money that could have gone to staffing, mental health services, or preventive care.

Price Controls Make Things Worse

You might think governments should step in and cap prices to protect people. But history shows that doesn’t work-and often makes shortages worse. The UK’s energy price cap, designed to shield households from soaring bills, led to 27 energy companies going bankrupt between August and December 2021. Why? Because they couldn’t cover their costs. The same thing happened in healthcare. When governments set fixed reimbursement rates for drugs, manufacturers stop making them if the price doesn’t cover production. In 2022, the U.S. saw a 22% drop in generic drug production because the prices paid by Medicaid and VA hospitals were too low to justify manufacturing. Harvard economist Martin Weitzman’s research on price distortion explains it clearly: when prices are artificially held low, people don’t just buy what they need-they hoard. One pharmacy in Dublin reported that after a news story about a potential shortage of thyroid medication, prescriptions for the drug tripled in one week-not because more people needed it, but because patients feared they wouldn’t be able to get it later.How Businesses Are Adapting-And What’s Working

Some healthcare providers and manufacturers are learning how to survive in this new reality. One solution? Dual sourcing. Instead of relying on one supplier for a critical drug or device, companies now build relationships with two or three. A 2022 McKinsey survey of 500 global health companies found that those using dual sourcing recovered from supply disruptions 35% faster than those who didn’t. Another fix? Digital visibility. Hospitals using real-time tracking tools for inventory saw stockouts drop by 28%. These systems alert staff when supplies are running low, so they can reorder before a crisis hits. Some Irish hospitals began using these tools in 2023 and reported a 40% reduction in emergency orders for antibiotics. Governments are also experimenting. Germany relaxed competition rules temporarily in 2021, allowing pharmaceutical companies to share production capacity during shortages. The result? A 19% drop in medicine shortages within six weeks.

What’s Ahead? The Long-Term Shift

The good news? Global supply chain pressure has eased since late 2022. The San Francisco Federal Reserve’s index returned to pre-pandemic levels by early 2023. But don’t celebrate yet. The International Monetary Fund warns that supply chain disruptions will remain 15-20% above normal through 2025. Why? Climate events, political instability, and the trend toward “nearshoring”-moving production closer to home-are making supply chains more expensive and slower to adjust. Gartner predicts that by 2025, 60% of major healthcare companies will use digital twin technology to simulate supply chain risks before they happen. That means modeling what happens if a factory in Vietnam floods or if a key raw material gets blocked by sanctions. It’s not science fiction-it’s becoming standard practice. But here’s the hard truth: no technology can fix what policy breaks. If governments continue to set prices below production costs, shortages will keep happening. If labor markets remain rigid-because of licensing rules, visa delays, or training gaps-hospitals won’t be able to staff up even when supplies return.What You Can Do

As a patient, you can’t control global trade or factory output. But you can be informed. - Ask your pharmacist if a medication has been substituted-and why. Sometimes, a generic version works just as well. - If you’re on a long-term drug, ask your doctor about backup options. Don’t wait until it’s gone. - Support policies that encourage diversified supply chains and fair pricing, not just price caps. - Don’t hoard medications. It makes shortages worse for everyone else. Healthcare isn’t just about doctors and hospitals. It’s about supply chains, global trade, labor markets, and economic policy. When those systems break, your health pays the price. The next time you hear about inflation or a drug shortage, don’t think of it as a distant economic issue. It’s your next prescription. Your next appointment. Your next chance at care.Why are healthcare drug prices rising so fast?

Healthcare drug prices are rising because of supply chain disruptions, concentrated production, and rising costs of raw materials and energy. When only a few manufacturers make a drug and one factory shuts down, supply drops fast. Demand stays the same-or increases-so prices spike. The Federal Reserve found supply shocks raise prices up to five times more than demand shocks. In 2022, generic antibiotics and IV fluids saw price jumps of 50% or more because of these bottlenecks.

Are drug shortages getting better?

They’ve improved since late 2022, but they’re not gone. Global supply chain pressure has returned to pre-pandemic levels, according to the San Francisco Federal Reserve. However, the IMF warns disruptions will stay 15-20% above normal through 2025 due to climate risks, geopolitical tensions, and the shift toward nearshoring. Some drugs, especially generics made in just one country, remain vulnerable. Hospitals still report occasional shortages of antibiotics, insulin, and anesthetics.

Do price controls help with shortages?

No. Price controls often make shortages worse. When governments cap how much pharmacies or insurers can pay for a drug, manufacturers stop making it if they can’t cover costs. In the UK and U.S., price caps led to drug shortages because producers exited the market. The Foundation for Economic Education and Harvard research show that artificially low prices trigger hoarding and panic buying, which drains supplies faster. Instead of caps, better policies include supporting multiple suppliers and adjusting reimbursement rates based on real production costs.

Why do some hospitals have drugs and others don’t?

Big hospitals and health systems have more buying power and better supply chain tools. They can pay higher prices to secure stock, use real-time inventory systems, and switch suppliers quickly. Smaller clinics, especially in rural areas, can’t. They often rely on a single distributor and can’t afford backup plans. During the 2021-2022 shortages, this gap meant some patients waited weeks for basic medications while others got them immediately.

What’s being done to prevent future shortages?

Companies are diversifying suppliers, using digital tools to track inventory, and building stockpiles. Germany allowed pharmaceutical companies to share production during the crisis, cutting shortages by 19%. The U.S. and EU are investing in domestic manufacturing of critical drugs. Gartner predicts 60% of major healthcare firms will use digital twin simulations by 2025 to predict and avoid disruptions. But long-term solutions need policy changes: fair pricing, flexible labor rules, and support for multiple production sites.

Can I stockpile my medications if there’s a shortage?

No. Stockpiling makes shortages worse for everyone else. If you take extra pills just because you’re worried, someone else might not get their dose. Pharmacists and doctors see this pattern every time a shortage is reported-prescriptions spike 2-3 times higher than normal, even though the actual need hasn’t changed. The best approach is to talk to your provider about alternatives and refill your prescriptions on time. Don’t wait until you’re out.

Aurora Daisy

December 24, 2025 AT 00:18Oh wow, another article that pretends this is some new mystery. My NHS nurse told me last week they’re rationing antibiotics like they’re gold bars. We’ve known for years that outsourcing everything to China and India was a disaster-now we’re just paying the bill. And don’t get me started on how the EU’s ‘fair pricing’ rules bankrupted local pharma. We didn’t need digital twins-we needed to keep our own factories open.

Paula Villete

December 24, 2025 AT 07:03Y’all keep blaming ‘globalization’ like it’s a villain in a Marvel movie. The real villain? Price controls disguised as ‘protection.’ When the gov pays $0.05 for a pill that costs $0.12 to make, guess what? No one makes it. I worked in supply chain logistics for 12 years-this isn’t rocket science. It’s basic economics. Also, ‘nearshoring’ sounds nice until you realize it means 3x the cost and 2x the delays. We’re fixing the symptom, not the disease.

Georgia Brach

December 25, 2025 AT 01:51The data presented is methodologically flawed. The Federal Reserve’s inflation attribution to supply chains lacks granular sectoral controls. The 60% figure conflates consumer goods with medical logistics, which have entirely different elasticity profiles. Furthermore, the JAMA study cited does not establish causality between substitution and treatment failure-it only reports correlation. Without regression analysis controlling for comorbidities, hospital capacity, and provider experience, these claims are speculative at best.

Katie Taylor

December 25, 2025 AT 02:23Enough with the ‘it’s complicated’ nonsense. We’ve got the solutions: build domestic production, pay manufacturers fairly, and stop treating healthcare like a charity. If we can spend $800 billion on weapons, we can spend $20 billion to keep insulin in stock. Stop waiting for ‘digital twins’ and start paying people to make stuff here. This isn’t a supply chain crisis-it’s a moral failure.

siddharth tiwari

December 26, 2025 AT 01:15u know wat this is? CIA and big pharma plan to control us. they make shortage on purpose so u pay more and get addicted to their drugs. they even made covid so u take vaccines and then u need more meds. watch the video on 911 truth-same people. they dont want u healthy. they want u dependant. my cousin in delhi got 3x price for metformin-coincidence? i think not.

claire davies

December 27, 2025 AT 10:01It’s heartbreaking, really, how something as simple as a syringe can become a political football. I remember in 2022, my mum in Cornwall had to wait six weeks for her thyroid meds because the one batch from India got stuck in Rotterdam. She’s 72, diabetic, and terrified. But you know what? The nurse who gave her half-doses? She’s a saint. And the pharmacist who quietly slipped her an extra pill? That’s the real healthcare system-not the headlines. We need more of those quiet heroes, not just tech fixes.

Harsh Khandelwal

December 28, 2025 AT 23:06lol at all these ‘solutions’. dual sourcing? digital twins? bro, just let the market work. if a drug costs 200 bucks, people will stop asking for it. simple. no need for gov meddling or ‘fair pricing’ fairy tales. if you can’t afford it, don’t take it. life ain’t fair. also, who even uses vancomycin anymore? i thought we had better stuff.

Christine Détraz

December 29, 2025 AT 21:53I think the real issue isn’t the supply chain-it’s the lack of transparency. If patients knew exactly why a drug was scarce-whether it was a regulatory delay, a factory fire, or a corporate decision to stop making it-we could make smarter choices. Right now, it’s all black box. And that breeds panic. Maybe the answer isn’t more control, but more information.

John Pearce CP

December 30, 2025 AT 04:33The normalization of systemic failure under the guise of progressive policy is precisely what has eroded the integrity of American healthcare. The notion that price controls constitute social justice is not only economically illiterate-it is morally indefensible. When the state intervenes to suppress price signals, it does not alleviate suffering; it redistributes it. The suffering of manufacturers, of workers, of patients denied care-these are the true costs of ideological overreach. The solution is not more intervention, but the restoration of market discipline, coupled with targeted, non-distortive subsidies for critical generics.